Caelus senior vice president of Alaska operations

Let’s look at why tax reform is working for Alaska, and why voters made the choice to give oil tax reform a chance to work.

First of all, Alaska is benefitting from exciting new investment in our oil patch since the tax law passed. Overall, the new projects that have been announced since SB 21 became law add up to more than $5 billion dollars. That is especially good news during a time of low oil prices, when other oil provinces have seen large lay-offs and a significant slow-down in activity. You asked for specifics, so here is what SB 21 means to a new company in Alaska.

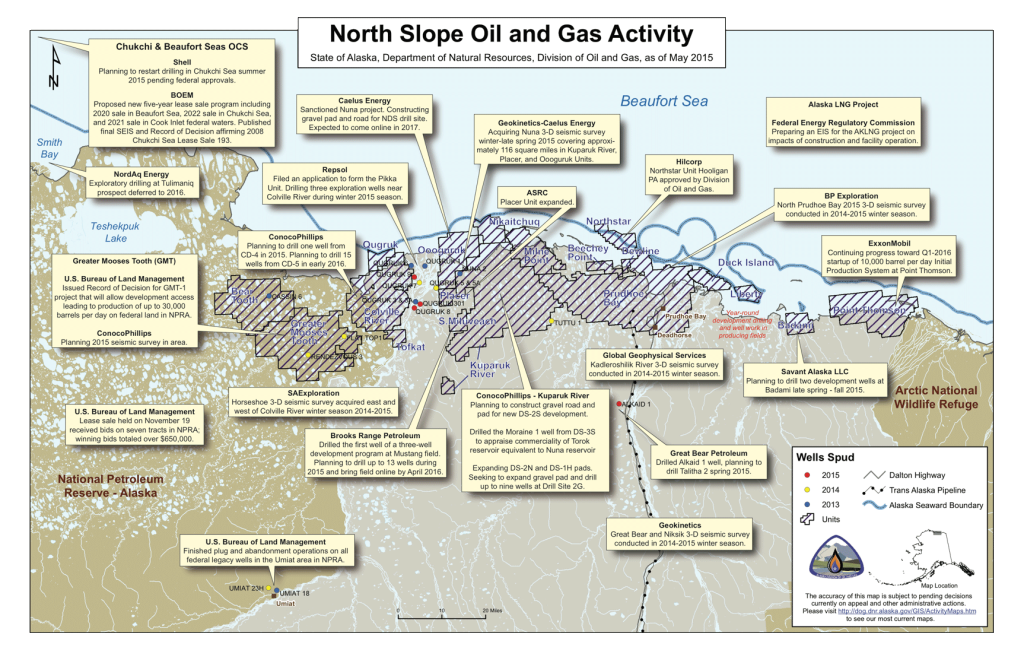

Caelus is in Alaska due largely in part to the passage of SB 21. Historically an international exploration company, the move to a more stable and competitive fiscal system attracted the attention of our company and investors. We purchased the Oooguruk Unit in April of 2014. Since then, we’ve been very busy:

- We sanctioned the Nuna project, a $1.5 billion new oil development and spent millions in installing the gravel road and initial drill site pad in 2015. First oil is expected in 2017.

- Caelus was one of the largest lease buyers during the fall 2014 lease sale, acquiring 323,000 new acres. This past winter we acquired new high-resolution, 3D seismic over both Nuna and our new leasehold in the east.

- Lastly, Caelus acquired a 75 percent working-interest ownership this summer in leases located in a highly prospective area known as Smith Bay in the shallow State waters outboard of NPRA. The company is fast at work preparing to drill up to two exploration wells this winter season.

As these projects move into the production phase, Alaskans will get the benefit of more oil moving down the Trans-Alaska Pipeline System and will enjoy royalties and production taxes that flow from these ventures. More activity and production means more jobs and a better outlook for the funding of public services, like education, healthcare and public safety.

The activities on the Slope are reason enough to be optimistic about Alaska’s future, but when you add in the fact that State revenues also look better under SB 21 compared to the previous regime, voters look even wiser. The new tax law was designed to protect the State’s pocketbook at low oil prices. When prices drop, as they have in the last year, the State collects more in revenues that it otherwise would have due to the gross minimum tax floor. One estimate puts the additional revenues made possible by oil tax reform at almost $1 billion over the next two years! Prices are still low, so Alaska’s revenue shortfall is still a challenge; but tax reform improved the situation markedly.

SB 21 is working for Caelus and other companies new to Alaska, and it’s working for Alaskans.