House Resources Committee — March 2, 2016 (video)

Chairman Nageak (Chairman Talerico) and members of the House Resources Committee, my name is Jim Jansen, Chairman of Lynden and Co-Chair of the Keep Alaska Competitive Coalition.

Thank you for the opportunity to testify this evening.

By way of introduction, Lynden is an Alaska, truck, marine and air Transportation Company who operates throughout the state with about 1,000 Alaska employees and hundreds of service partners.

The KEEP Alaska Competitive Coalition was founded as the Make Alaska Competitive Coalition in 2011 to advocate for change in Alaska’s oil tax policy to encourage investment in Alaska. As you may recall, production declined by more than 200,000 barrels a day under the uncompetitive tax policy called ACES.

KEEP is a broad-based group of approximately 8,000 Alaskans, Alaska businesses, Native corporations, individuals and organized labor. We received no funding from the oil industry. After the defeat of the SB 21 referendum, we thought we could retire our coalition but here we are, facing another proposed change, which will send Alaska backward in oil tax policy.

I came to Alaska as a truck driver in 1967, and other than my military service, have lived in Alaska ever since. Alaska was my home before North Slope oil. I operated a trucking business thru the post-pipeline construction recession, and led Lynden since the recession of the 1980s.

Vicki and I have lived the dream in this great state, both from a business and personal perspective, fueled by a strong economy, driven by our resource industries. Personal and business opportunities over the past 49 years make us feel like the luckiest people on earth. I am now nearing the end of my working career, and have focused much of my energy on the future of the next generation of Alaskan’s.

I am here today because I am afraid that Alaska may revert to the economy I faced in 1967. An economy, without the North Slope would be devastating for Alaska, and Lynden. At Lynden, we would be facing massive layoffs of our outstanding Alaska employees – as our state speeded towards economic ruin. I don’t scare easily, but I can tell you that I fear for our State and Lynden’s people, if the legislature tries to solve Alaska’s fiscal problems by imposing unreasonable taxes on our resource industries.

How we deal with our fiscal challenge will determine if we retain the Alaska we have enjoyed since the development of Prudhoe Bay. Alaska needs to adjust, to live within our means, but we cannot do it on the backs of our resource industries. We may have to sacrifice a portion of our PFD and we may need to pay taxes, too.

To put my testimony in perspective, first let’s acknowledge the situation we find ourselves in with $30/bbl. oil prices. We all know the size of our current deficit and we all know we need to deal with it sooner rather than later.

Our state is facing a massive fiscal crisis unseen in more than 30 years. We thank the Legislators and the Governor who are willing to put Alaska’s long- term economic future ahead of short-term politics. There is nothing more important for our state than to solve our budget deficit and build a sustainable economic future for our State, but, we can’t do it on the backs of an ailing industry that already pays most of Alaska’s bills.

I agree conceptually with much of the Governor’s plan: use of the permanent fund earnings, reduction of our dividend program, reducing the operating budget, and instituting some new taxes. One part of the Governor’s plan that does concern me, however, is the proposal for yet another change to our oil tax policy.

I have three main points that I wish to make this evening:

- Increasing oil taxes and reducing credits at a time when the industry is losing money on Alaska production sends the wrong message to an industry that has responded well to our desire to see more investment and more production – even at a time when oil prices have plunged.

- Maintaining a healthy oil/gas industry in Alaska is vital to our future if we want to keep oil flowing through the pipeline and keep alive any serious prospect for a gas line.

- As we deal with the painful economic transition caused by low prices, we need to be mindful to protect the viability of all of our resource industries as they continue to be a major source of employment and income to Alaskans – not to mention important taxpayers.

While passage of SB 21 does a better job of protecting revenues at low oil prices than the prior tax structure, HB247 raises the tax from 4 to 5%, and eliminates loss credits, adding a new tax burden to the petroleum industry at a time it is losing approximately $22 for each barrel of North Slope oil produced. Changing the credits is effectively a tax increase. As a state, we wanted the industry to produce oil that we know is more expensive to get out of the ground – and we promised them an incentive to do so. They did just that.

Despite these sobering times, the industry has upheld the commitment it made when the Legislature passed SB 21, the More Alaska Production Act. It pledged to increase investment – and it did, to the tune of $5 billion. That investment has led to more production and a leveling off of the production decline through the pipeline.

Industry is still investing substantially more in Alaska, than other regions because SB21 encourages investment. Compare Alaska to North Dakota, Texas, Canada – and most other oil provinces, and we can be extremely thankful we are living and working in Alaska today.

An increased tax on the petroleum industry today, would send a terrible message, namely, that Alaska is a high-risk tax environment and that we are an unreliable partner who does not live up to its commitments. A natural response from the industry would be to curtail their investments here and move them to a more stable and profitable oil province. We would have made it very easy for them to cease investment here.

What do you think would happen today, if Lynden told an oil company today, that we will be raising your freight rates by 25 percent? Obviously, they would shift their business to our competitors. Alaska, like Lynden, competes for investment, and this is the wrong time to increase rates.

HB247 would mark the sixth major tax change in 11 years. Attracting investment requires a fair and stable tax structure. Tax credit policy should not be a whip-saw for filling the budget deficit; it should be a thoughtful approach to a stable and growing economy.

Our oil production peaked at over 2 million barrels per day and is now approximately 500,000 per day. To keep a minimum flow in the pipeline and to obtain the value of what oil remains in our state, we need the industry to continue drilling, continue investing, and to have enough faith in us as predictable and reliable partners to invest $50 to $60 billion in a gas line. Continually changing our tax structure makes us predictable in the wrong sense.

The oil and gas industry, like the mining and fishing industries, provides a major source of good-paying jobs in our economy and hopefully will continue to do so well into the future. The tough choices that we have to make to reduce our deficit need to be done in a way that minimizes the shock to our economy in the next several years and are mindful of the economic base that we need for our future.

We are fortunate to have almost $60 billion in savings to help us with the transition towards an investment-based budget. Let’s start using the earnings of those savings as suggested by the Governor, Senator McGuire, Representative Millett and Representative Hawker, along with a reduced budget and carefully considered taxes and user fees to close the gap.

We all know that taxes on our resource industries are politically easier than taxes on our residents. But our resource industries are the last place we should look for quick tax revenue. They are the backbone of our economy, and in the case of oil and gas, they are swimming in an ocean of red ink. Raising taxes on the resource industries are the surest way to drive away investment, which is the only way to grow the economy.

Fortunately we have the financial resources to not only survive – but prosper. What we need now is the courage to responsibly continue to drive down the cost of state government and utilize the permanent fund as intended, to fund state services. We will need to pay taxes ourselves; however, the last place we should look for new revenue is to unfairly tax the very industries that drive our economic future. If we push them away, our economic future will be hopeless.

This is a time for Alaskans to support responsible fiscal policy.

Thank you.

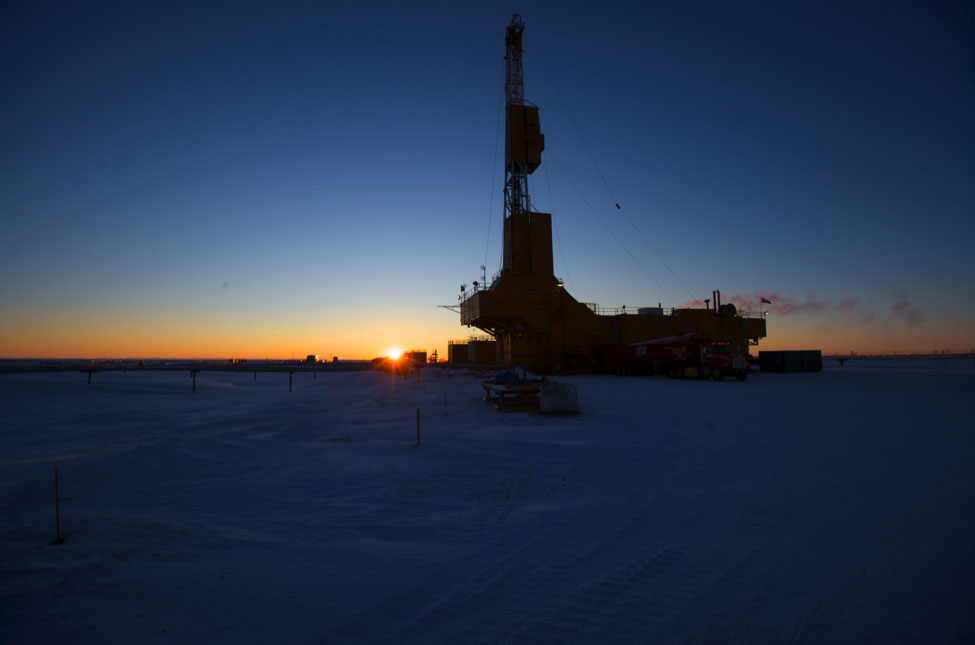

When ConocoPhillips began producing the first-ever oil from the National Petroleum Reserve-Alaska this fall, the moment was hailed as a triumph of perseverance – and a victory for oil tax reform.

When ConocoPhillips began producing the first-ever oil from the National Petroleum Reserve-Alaska this fall, the moment was hailed as a triumph of perseverance – and a victory for oil tax reform. One of the brightest spots on the North Slope lies 60 miles east of Prudhoe Bay, on the edge of the Arctic National Wildlife Reserve.

One of the brightest spots on the North Slope lies 60 miles east of Prudhoe Bay, on the edge of the Arctic National Wildlife Reserve.